Fuel hope for people facing cancer today and earn a tax credit

Every 3 minutes someone in Canada hears the life-changing words, "You have cancer."

When you donate to give hope to your loved ones and community members facing cancer, you also reap the financial rewards when you file your taxes. Get money back in your pocket with a tax receipt that we’ll issue to you in February.

By making a recurring donation in an amount that works for you, you’re supporting long-term research with the potential for groundbreaking discoveries – without breaking the bank.

How much could you get back on your taxes with your recurring donation?*

On top of supporting world-leading research that saves and improves lives, you’ll get an annual tax receipt in February that you can use to get money back when you file your taxes.

Use our calculator to find out just how much money you could get back in your pocket.

Make a big impact, on your timeline

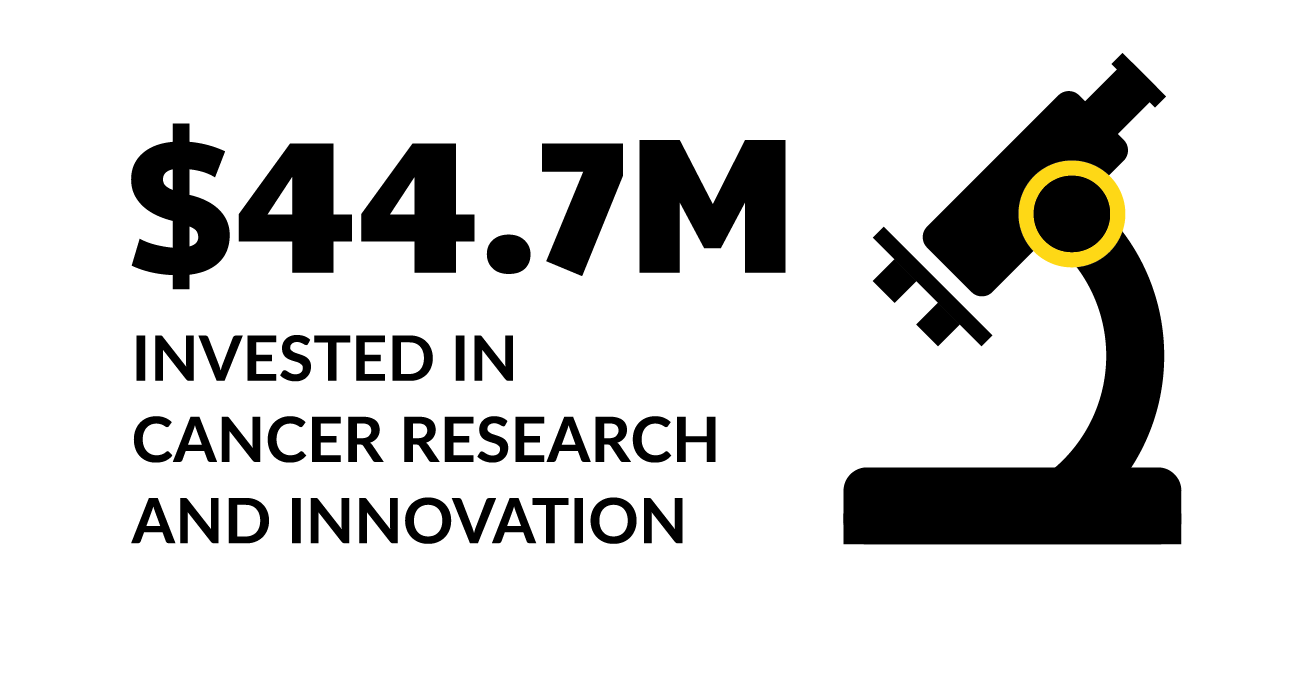

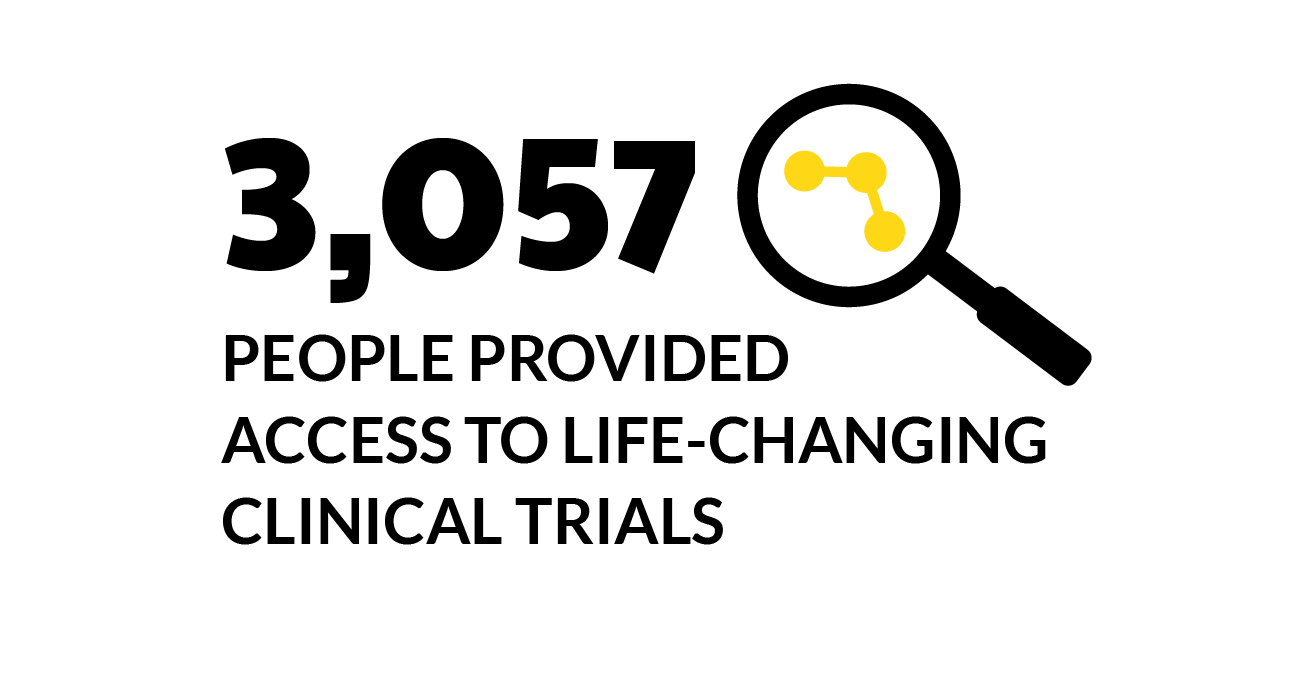

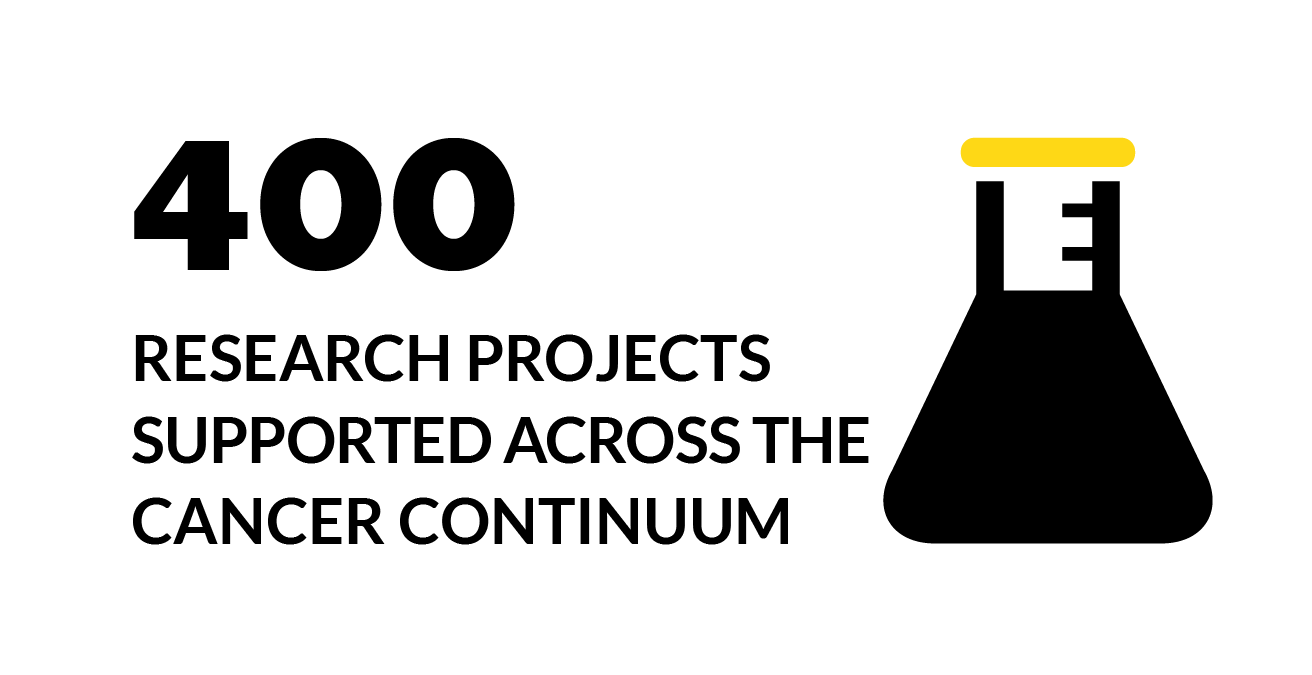

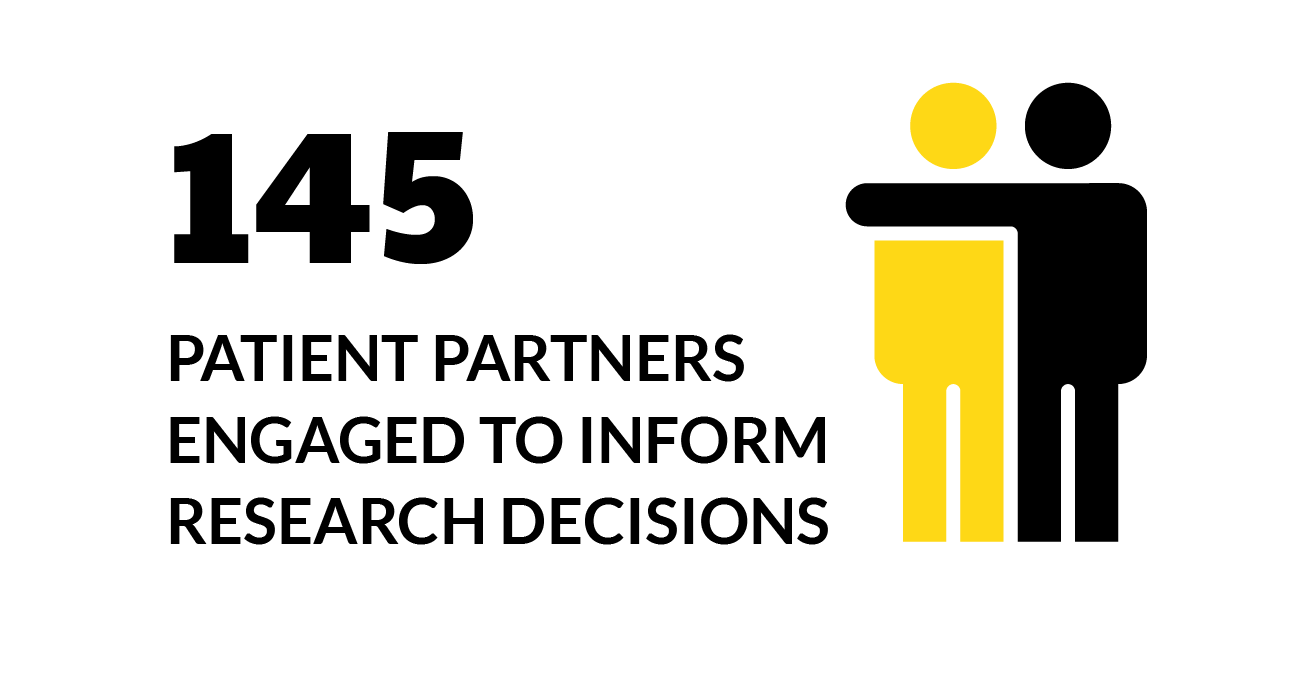

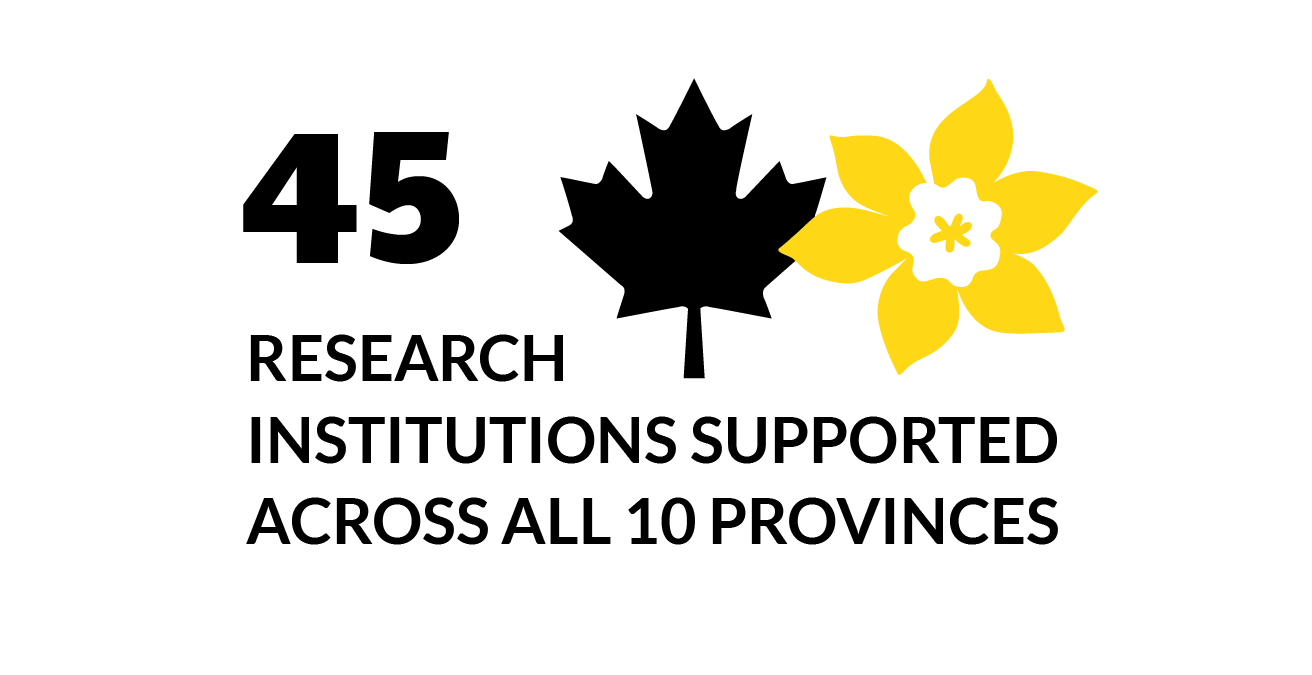

Your contributions can help keep up the momentum of world-leading research and have a big impact for people facing cancer.

To share your impact, we’ll send you quick updates on the progress you help make possible. You can also review annual impact reports and audited financial statements any time.

DISCLAIMER

*This calculator estimates the non-refundable tax credit for eligible donations based on your province or territory of residence and donation amount. It does not account for all tax situations, including higher rates for top income brackets or recent tax changes. Since calculations depend on the accuracy of your entries, please ensure they are correct. As a non-refundable credit, it reduces tax owed but does not result in a refund if no tax is due. Additional restrictions may apply based on income and provincial considerations. For the latest updates visit Canada Revenue Agency and/or speak to a financial advisor, for more information about eligible donations and receipting, visit our FAQ page.